Texas Property Tax Cut 2025. That new revenue would help pay for the tax cuts. In texarkana isd, for example, the 2025 tax rate is $1.2113 per $100, meaning a $300,000 home would owe $3,633.90 in school property taxes.

A bill that will reduce statewide property taxes for texas homeowners by roughly $18 billion went into effect jan. Governor greg abbott today ceremonially signed legislation delivering the largest property tax cut in texas history—$18 billion—passed during special session #2 of the 88th legislature in new caney.

State lawmakers signed off thursday on an $18 billion package of property tax cuts for texas homeowners and businesses, capping months of friction between.

In july 2025, abbott signed into law an $18 billion property tax relief package for texas homeowners.

Increase texas homestead exemption to $100k on 5.72 million texas homeowner’s isd property tax bills, effective on this year’s property.

![Texas Homestead Tax Exemption Guide [New for 2025]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas lawmakers present property tax plans, The existing child tax credit is worth up to $2,000 for each qualifying dependent under 17, but it is reduced for married filers once their income exceeds. State lawmakers signed off thursday on an $18 billion package of property tax cuts for texas homeowners and businesses, capping months of friction between.

Governor Abbott Statement On Passage Of Historic Property Tax Cuts, What are we voting on? Governor greg abbott today issued a statement following the texas house of representatives passing hb 1/hjr 1 for.

Texas Homestead Tax Exemption Guide [New for 2025], Property tax savings are historically hard to achieve in texas. Billions in property tax cuts need texas voters’ approval before taking effect.

Commentary How Property Taxes Work Texas Scorecard, A bill that will reduce statewide property taxes for texas homeowners by roughly $18 billion went into effect jan. The deal would channel $12 billion to reduce the school property tax rate for homeowners.

What You Need to Know About Property Tax in Texas, The new law passed with 83% of the vote in. Governor greg abbott today ceremonially signed legislation delivering the largest property tax cut in texas history—$18 billion—passed during special session #2 of the 88th legislature in new caney.

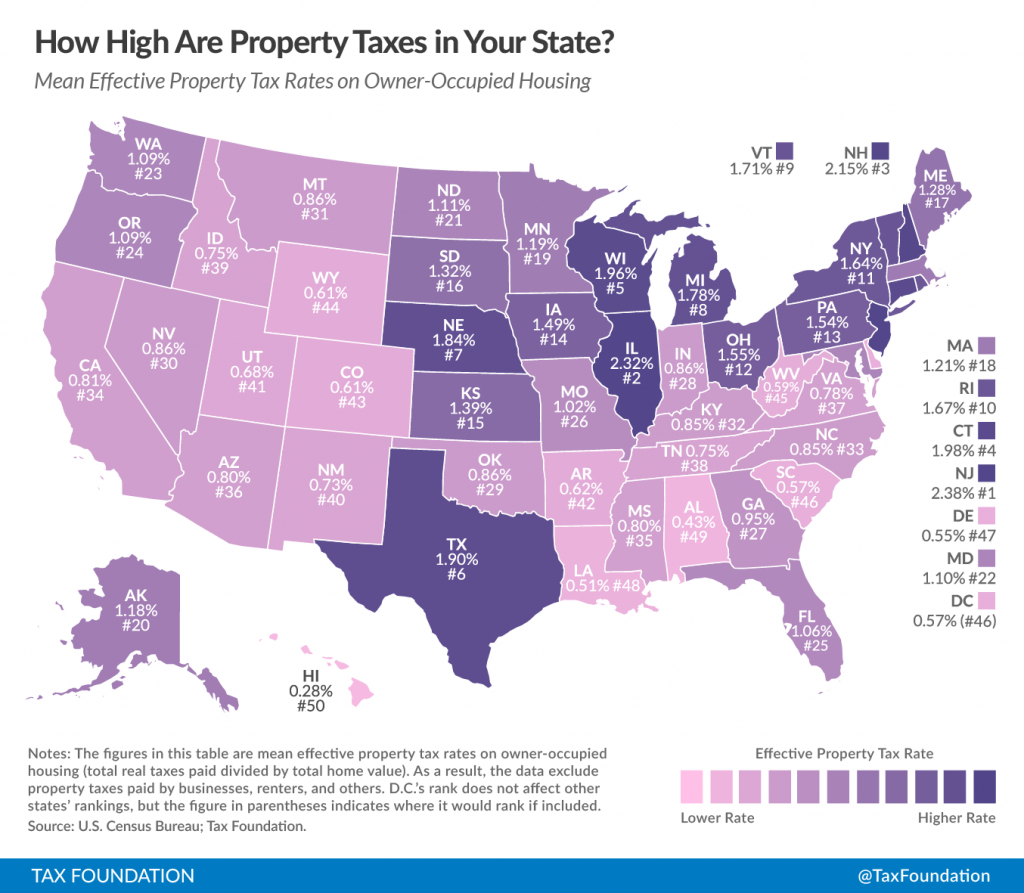

How High Are Property Taxes In Your State? Tax Foundation Texas, In texarkana isd, for example, the 2025 tax rate is $1.2113 per $100, meaning a $300,000 home would owe $3,633.90 in school property taxes. Phelan’s proposal — carried by house ways & means chair morgan meyer, a dallas republican — calls for $12 billion in school property tax cuts on top of the $5.3.

Replace Property Tax Republican Party of TexasRepublican Party of Texas, Texas house and senate reach a deal on how to cut property taxes. August 9, 2025 | austin, texas | press release.

How High Are Property Taxes In Your State? Tax Foundation Texas, That new revenue would help pay for the tax cuts. Under the new legislation, local governments are to stop.

What Do Property Taxes Pay For in Texas? Where Your Taxes Go, That’s why the state’s plan, which will cut the m&o rate by 11 cents for every $100 of a property’s value, will mean big savings for landlords, developers and. State lawmakers signed off thursday on an $18 billion package of property tax cuts for texas homeowners and businesses, capping months of friction between.

Which Texas MegaCity Has Adopted the Highest Property Tax Rate?, Greg abbott has signed an $18 billion tax cut for texas property owners, sending the proposals to voters for their approval later this year. Phelan’s proposal — carried by house ways & means chair morgan meyer, a dallas republican — calls for $12 billion in school property tax cuts on top of the $5.3.

State lawmakers have reached agreement on an $18 billion deal to cut property taxes, a record for texas.