2025 Tax Brackets Vs 2025 Income Tax. The irs adjusted tax brackets higher by 2.8% for the 2025 tax year. The changes are meant to offset the impact of inflation.

When you are looking at the federal tax brackets, you are able to determine which tax rate applies to you for the current tax season which allows you. In a nutshell, the top income limit for each bracket is going up.

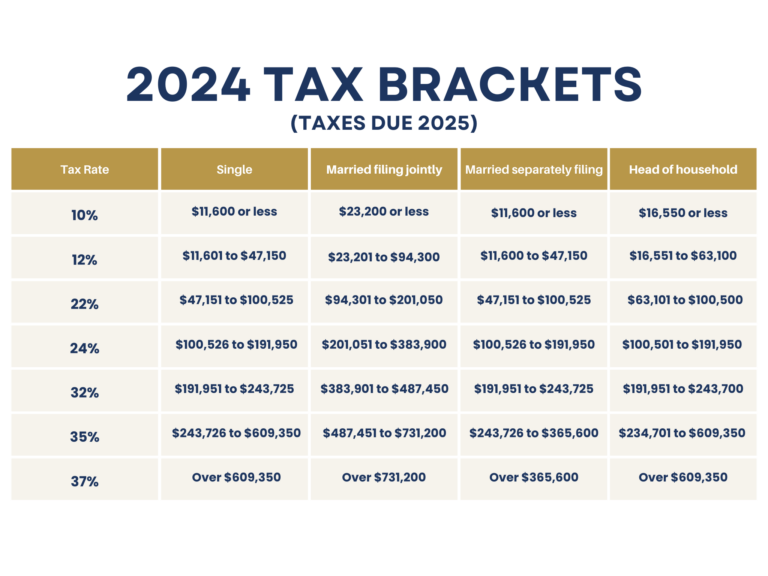

2025 Tax Brackets Vs 2025 Calculator Clovis Miquela, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Vs 2025 Tax Shay Yelena, The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Vs 2025 Tax Rates Valry Jacinthe, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, Married filing jointly for 2025 taxable.

2025 Tax Brackets Chart Mela Stormi, The internal revenue service adjusts federal income tax brackets annually to account for inflation, and the new brackets can help you estimate your tax obligation based on.

2025 Tax Brackets Announced What’s Different?, For tax year 2025, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses: